Hey there, Skill Miner is online! Today I have for you one more interesting tool. Applying it in production management (or in services) can help you to find more room for improvement. I would like to present a very simple and comprehensive way how to calculate equipment depreciation and how to afterward calculate the direct cost of used machinery. If you use different types of machinery in your company to produce value it is of critical importance for products pricing as well as for optimization estimations.

Some theory behind

First of all, it is not true that being able to calculate depreciation and operational costs is solely financial or bookkeeping task. In some cases yes, it is. But mostly for creating financial reports. Usually, everybody is trying to make these reports either very attractive to involve more investors or to satisfy the current ones or to make them less attractive to pay fewer taxes. I think everybody heard about huge scandals about faking financial reports. Read here about the cases in more details.

In our case, we stay focused more on the pricing side and possible cost reduction. These two tasks usually belong to Project Managers, Sales Managers or Process (Industrial) Engineers.

We must distinguish that depreciation is not the same as amortization. Amortization is a method of spreading the cost of an intangible asset over a specific period of time. While depreciation is a method of spreading the cost of a tangible asset over a specified period of time. This is the difference we will operate with. For more details, please, read this article. Pretty simple taxonomy.

In this article, I will also provide an excel table that can help you make calculations for your own case.

Practical guideline

Specify necessary parameters for depreciation calculation

Whatever you start it is smart, to begin with data collection. The key knowledge here is to know which data you need to make the calculations. Depending on the age and size of your company you might have more or fewer data available. But you must, nevertheless, always be able to work with what you have. Any calculation independently how accurate it is, is always an estimation with some tolerance.

Based on the depreciation definition what we need is:

- a period an asset is planned to be used or Useful Life;

- a capital investment in this machinery;

As we can see the depreciation itself in this calculation has only 2 parameters.

Parameter 1. Useful Life

Usually, the Useful Life is specified either by regulatory bodies or by the Top Management (Board of Directors). You must understand it as the following. It is the period during which all the costs imposed by purchasing of this machine will be evenly distributed among the goods (services) produced by this machine. It doesn’t really mean that machine’s value from the functional point of view is zero, it simply means that it has paid back. Figures to start with are 10 or 5 years. Please, bear in mind that depending on the Useful Life you select the cost of depreciation is changing. Thus it is a Top level decision to define it. The company has to stay competitive in the market. Nobody wants to have depreciation costs shooting to the stars.

In our calculation, we will relate depreciation cost to the direct costs of the product. It means that we use only the net time of machining time.

Parameter 2. Capital investment

To get this figure you need to go to the bookkeeping or financial department. This value can be considered in different ways depending on the way how the machine was purchased. Was it a loan, state grant, outside investment and etc. In our simplified calculation, we will consider only one case – buying by own capital.

Now we need to define the rest of the parameters, which we should include in the calculation.

Parameter 3. Monthly usage hours

This value depends on the intensity of the workload in your company. To be flexible it makes sense to create two subparameters here: shift duration and number of shifts monthly. In our calculation let’s approximate with 8 hours shift and 20 days per month working mode.

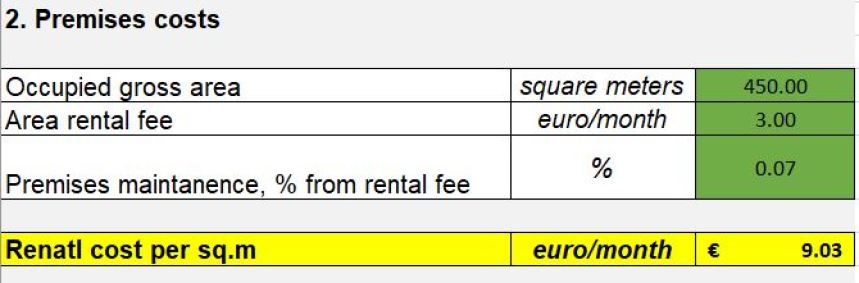

Parameter 4. Occupied gross area

I guess it is obvious that the machine is not just soaring in the thin air. It occupies some area for which you have to pay. It can either rental cost or again depreciation. In this calculation, we will consider renting the shop floor.

As long as it is an estimation let’s also appoint some percentage for premises maintenance and repair. From 5-10% from renting cost. This coefficient depends on the country you work in. This cost can be calculated by the end of the first operations. You can also request such information from bookkeeping.

Parameter 5. Personnel costs

Even if we are talking about fully automated production there is still somebody there to set-up, program and maintain machines. To calculate personnel cost let’s define the following subparameters

- Operator’s gross cost for the company;

- Number of operators;

- Engineers’ gross cost for the company;

- Number of engineers;

Parameter 6. Equipment insurance

It depends of course whether you have it or not, let’s consider that you do.

Parameter 7. Electricity costs

If we are not talking about a hammer that needs only human power, we have to supply somehow the energy. And for the energy, we have to pay.

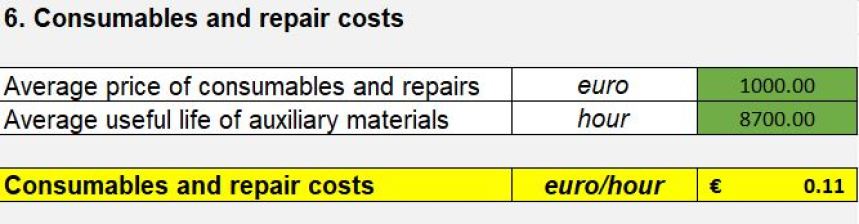

Parameter 8. Consumables and repair

All these lovely things that operators like to spend in huge amount like gloves, masks, knife blades and so on.

Parameter 9. Unexpected costs

No one is perfect and everybody makes failures. A small safety factor wouldn’t be redundant. You can appoint from 5-10%.

Parameter 10. Overhead costs

It is the cost of all other administrative personnel that doesn’t participate directly in value creation. It is up to you (or your management) whether to include it or not. The percentage must be defined by a top management or calculated based on statistical data from operations.

Let’s appoint 30% in our calculation.

Parameter 11. Margin

So, here we are finally at the point where we define how much profit we want to get from each an every hour of this piece of equipment working for a customer. This value depends a lot on the country, industry and production type. Can be as low as 3% or shoot up to the crazy 100%, like in many developing countries.

Let’s select something like 20%.

Finalizing the calculations

We defined all the parameters and defined their values now is time to put it into a table. [Equipment cost_Template]. Please have a look at it and if you have any further questions feel free to write them in comments.

Thanks to this calculation we can now define how much one hour use of machine costs and also for how much we can sell our excess capacity if we have it.

What is also important for an Engineering team is that now the cost structure is absolutely transparent. We can see where the biggest impact comes from and we can, for example, reduce personnel presence or reduce energy consumption by improving processes. Or we also can optimize consumption of auxiliary materials.

One of the main targets of such tools like 5S, PDCA or Value Engineering is to make the system transparent. Intransparency leads to chaos and consequently to failures. Intransparency in production is good for people who are trying to hide their failures and real reasons for unmet deadlines. In the companies, where the culture is oriented on developing of problem-solving mindset and continuous improvement philosophy such tools are used on a day-to-day basis.

This calculation is useful not only productions but for any businesses with tangible value adding objects. For example, an engineering company can consider PCs as equipment and I am pretty sure they do.